Financial Management

Financial management is a process of making decisions on how to acquire and utilize financial resources effectively with an objective of maximizing profitability.

a)Importance financial management inCommercial Zones

The farmer organizations need to be able to work together inorder to be able to leap full benefits including:

- Facilitates contractual farming and/or contractual production for groups

- Promotes individual savings at the commercial zone account

- Small level loaning facilities can be available for members

- Group loaning on viable business opportunities becomes possible

- Running high investments projects using combined resources

- Private sector companies are keen to train and support organized groups

- Group savings ensure a lump sum payment to the members

- Micro finance institutions are keen to lend to organized groups

- Collective marketing increases product volumes thus increasing chances of attracting more buyers

- Proper saving schemes enable members to reduce mismanagement of funds both for groups and for members

A good financial management system ensures the following;

- Limited financial resources are utilized optimally in the group/Commercial Zone

- The cash flow position of the group/ commercial zone is not jeopardized

- The right sources of finance are targeted

- Capital needs are carefully worked out to ensure the necessary assets are obtained (for example, should land and buildings be purchased or rented?)

- Governance at the commercial zone level is strengthened and informed decisions can be made

b)Consequences of lack of sound financial management

- Cash flow problems which affect operations negatively

- Inability to pay accounts such that debts increase

- Insolvency and the shutting down of the commercial zones

- Loss of money that members or worker-owners have put into the group

- Loss of livelihood and other benefits from the commercial zones

- Loss of assets and resources

- The reputation of the members and the commercial zone is discredited

- Conflict within the commercial zones

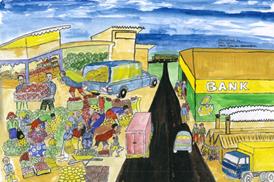

Example of commercial zone money uses

c) Financial planning

Commercial zones must work out a budget for all the operations to be undertaken and explain how the activities will be financed.

Some of the steps to financial planning that can be considered are:

- Determining your current financial situation.

- Developing financial goals.

- Identifying alternative courses of action.

- Evaluating alternatives.

- Creating and implementing a financial action plan, and.

- Reevaluating and revising the plan.

|

Questions for Discussion

|

d) Budget

A budget is a statement about the allocation of money (income and expenditure) according to a set of priorities or a plan over a period.

A budget is a statement about the allocation of money (income and expenditure) according to a set of priorities or a plan over a period.

Develop a clear budget. This should indicate how much money you need for all the activities. After creating a budget, you should be able to see how much savings you have to meet the budget. At the same time if there is deficit you will be able to see how much money you need to borrow to supplement the needed budget.

Proper budgeting gives the following advantage to a farmer:

Proper budgeting gives the following advantage to a farmer:

- Ensures plan and objectives of the farming activity is fulfilled

- It helps to measure performance of the farm as an enterprise

- It is also a motivational tool because it gives direction.

e) AnchorAccess to Finance for Smallholder farmers

Finding the money to start the agribusiness or any other small business is usually one of the early challenges that entrepreneurs face. For most people, this process can be hard and very frustrating. What makes this process frustrating is a combination of wrong expectations and looking for money in all the wrong places. Below are a few examples of where to get money

i.Personal savings

Most entrepreneurs start their business by using their long saved money. This source of financing puts you in full control of how much you are going to get. Saving up to, start a business takes determination and sacrifice. Saving requires someone to give up luxuries – buying expensive clothes, holding expensive family events, etc.

ii.Family members and friends

One common way to finance a business is to ask friends and family members for financial support on your investment. However, among the challenges with this source is that if things go wrong, your friend/family relationship might be affected. In addition, for business, you are guaranteed that things will go wrong at one point or another. It is therefore advised that if you get financial support for business by using friends and family investors, decide whether they become part of the business or you take a loan from them.

iii.Microfinance institutions

Microfinance refers to an array of financial services, including loans, savings and insurance, available to small entrepreneurs and small business owners who have no collateral and would not otherwise; qualify for a standard bank loan.

Microfinance refers to an array of financial services, including loans, savings and insurance, available to small entrepreneurs and small business owners who have no collateral and would not otherwise; qualify for a standard bank loan.

MFI exist in different forms such as MFI banks, Profit and not for profit, Money Lender, and Merry –go – round. Each of these forms has advantages and disadvantages. It is important the borrower learn before deciding on where to source his/her financial need.

Types of Savings Contributions

- Saving with banks for interests

- Saving with SACCOs for dividends loans and guarantees

- Saving with MFIs for cash collateral

- Merry go rounds

- Table bank savings

iv) The bank

iv) The bank

The bank is the last option for startup business because in most cases banks lend only against assets. Unless you have a business with assets or you have substantial personal assets, you will not qualify for a commercial line of credit or bank loan. However, bank loans may be a good source of funding later on, once your business has grown.

Savings Management

Savings contributed by members should be banked the soonest possible; it is a responsibility of finance subcommittees. A clear savings record keeps members informed of who is

- Under performing,

- How much more effort is required

- How well the transactions are taking place without suspicion of mismanagement

f)Primary reasons for credit requirements by farmers

Some of the reasons why borrowing money is important for Smallholder farmers or small-scale agribusiness owners are as follows:

- Credit can be used to hire labourers, or tractors to clear and prepare the site for planting.

- To acquire improved inputs for planting- such as seeds, fertilizers, and pesticides/herbicides. Poor yields from small-scale farmers are often because of use of poor input seeds and lack of fertilizer. With access to credit, this situation can be improved

- With access to credit, smallholder farmers can increase their production, so that they graduate from subsistence farming to production for sale. Therefore, credit allows farmers to grow their businesses.

- By borrowing, small farmers can solve any cash flow problems. For instance, the farmer might not have enough cash to bring in a big harvest, yet his produce has ready market. Accessing credit can allow the farmer to hire labour so that the proper harvest and post-harvest is done.

- To buy machinery and equipment such as tractors.

- Credit is important also in fulfilling other personal and family needs such as paying school fees.

- Ability to borrow also enables small scale farmers to deal with emergencies, such as medical emergencies or death of loved ones.

- Without a doubt therefore, the ability to access credit can provide a significant improvement in the business operations of small scale farmers.

g)Primary requirements for lenders (Credit Appraisal scheme for lenders)

Before you think of accessing financial services, you need to know the basic requirements that lenders would like to find out about a borrower. These differ from one lender to another but the five below are proven conditions that are prerequisites for accessing funds.

Character: Credit worthiness considers the character of an individual. The lender would want to know how strong your character is when handling money. Is your credit history clean enough to be trusted for more funds? How do your community and peers define you? What is borrower's reputation for repaying debts?

Capacity: Lenders need to determine whether you can comfortably afford your payments. Does your business provide sufficient income that will make you pay the loan? What level of experience on the business enterprise of which an individual is borrowing money for? This increases confidence to lenders because of the risk attached to lending.

Capital What is your capital? How are you expected to pay this loan? Suppose the business fails, do you have an alternative way to repay the loan?

Conditions refer to how a borrower intends to use the money. Lenders want to know how you plan to use the money and will consider the loan’s purpose. They are more willing to approve loan for specific purpose than the loan that may be used for anything. Lenders will also want the borrower to stick on that purpose.

Collateral/ Security Many people thinks about collateral as number one requirement; however, serious lenders put this as a last requirement. The first four requirements play a major role in borrowing. Nevertheless, collateral can help a borrower secure loans. It gives the lender the assurance that if the borrower defaults on the loan, the lender can repossess the collateral.

h)Questions to ask before applying for financing

The farmers should ask themselves before starting looking for a place for borrowing the following questions:

- Is my credit history good enough to support me to the lender?

- Do I have a clear business need for the loan?

- Do I have a clear work plan or business plan?

- Do I have market for my produce?

- Do I have experience in the activity for which I intend to take out a loan?

- Am I a hard worker?

- Do I have collateral to take to the bank?

- Do I belong to a group through which we can jointly access agricultural loans?

- Do my fellow group members feel that I have the capacity to manage a loan?

Financial facilities available to farmers

- Warehouse receipting

- Invoice discounting

- LPO financing

- Asset finance

i)Risk associated to borrowing and mitigation strategies

Accessing Credit or Borrowing is defined as taking money in cash from a financial institution, a group or from any individual; with the commitment that this cash will be paid back at some defined time in the future. Borrowing money can be very important for meeting the costs of your business, meeting family subsistence needs and growing your business. However, borrowing money entails taking on risk, because when you borrow, money, it has to be repaid back fully with interest, and normally within a given period of time.Access to finance through borrowing has risks that both the lender and the borrower might encounter. It is paramount for the two sides to foresee such risks and find the best ways possible for mitigation. Below are some risks related to borrowers?

|

Risks of borrowing |

Mitigation options |

|

Enterprise risks- e.g. business failure/non-performing, machinery breakdown |

Build diversified asset portfolio Financial planning to ensure availability of working capital. Maintain periodic services to machines |

|

Life cycle events |

Diversify income sources Engaging in social networks for support in such events |

|

Illness and death |

Consider insurance Engaging in social networks for support in such events |

|

Unanticipated crises and emergencies

|

Diversify income sources Better manage money |

|

Accidents, robberies and crime

|

Engaging in social networks for support in such events Consider insurance |

|

Natural calamities eg. Flood, earth quake, drought |

Better manage money Crop Insurance Consider irrigation |